Green Markets #1

Financial news in environmental markets.

Green Markets is a weekly series dedicated to highlighting events of interest or developing trends within environmental markets. The emphasis is on news that could impact investable opportunities in public stock markets.

SEC Climate Disclosures in Limbo

The SEC recently approved a ruling on climate disclosure regulations for public companies. I discussed the details in-depth in this video. These new rules include:

Reporting any risks associated with climate change that may have a material impact on a business’s strategy or its operations.

The company’s process for identifying those risks, if any.

Any actions that are currently being taken to materially avoid said risks.

Defining climate targets within the context of the company’s goals.

Outlining potential costs/risks from natural disasters or other weather events.

Disclosing Scope 1 and Scope 2 emissions by 2026-2028, depending on the company’s size.

In my opinion, these rules would only increase pressure on large companies to develop decarbonization plans and take genuine action. Everyone will know if you aren’t doing anything tangible about your emissions levels.

As you can imagine, the fossil fuel lobby and Republican districts weren’t pleased with what the SEC was suggesting.

The ruling was subsequently halted by the Fifth Circuit Court of Appeals (FCCA) shortly after it was approved.

Oil field service companies Liberty Energy and Nomad Proppant Services have filed lawsuits to challenge the SEC. They’re not the only ones either.

Well, this temporary suspension didn’t last long, because the FCCA just reinstated the SEC’s ruling in less than a week. It seems like these regulations could be in political and judicial limbo for quite some time.

With the more taxing requirements still a few years out from taking effect, there’s a good chance all of this will be solved by the time they roll around.

Kasikornbank Embracing Green

Thailand’s second-largest bank, Kasikornbank, has dedicated $2.7B to funding energy transition efforts within the country throughout 2024.

The focal points of this initiative include:

Offering green bonds to customers.

Serving as an advisor on environmental solutions.

Reducing carbon emissions from its capital portfolio.

Integrating with the carbon markets to provide carbon credit transactions.

The financial system is increasingly embracing a move toward a greener economy. As mentioned previously, this isn’t out of the kindness of their hearts. There are growing monetary incentives to taking this stance. That’s a key driver to the upside of a variety of environmental industries.

Banks Disclosing Green Financing Ratios

Disclosure invites scrutiny, and large banks are set to actively attract more eyes to their activities in the fossil fuel space.

The New York City Comptroller, Brad Lander, has filed resolutions at six major banks to reveal their relative levels of financing for low-carbon energy sources vs fossil fuels.

Both Citigroup and JPMorgan Chase have agreed to do so.

Morgan Stanley, Bank of America, Goldman Sachs, and the Royal Bank of Canada are expected to vote on their respective measures during the upcoming proxy season.

Again, this further incentivizes these firms to raise funding efforts for renewables and other cleaner sources of power.

Depending on how that funding is sourced, this can be a net negative for the green transition. Prioritizing going green to the detriment of the average consumer via higher fuel prices in the short/medium term, isn’t the outcome we want. The general population wouldn’t take too kindly to the idea, either.

We can’t rush the movement away from existing infrastructure that we’ve been operating under for over a century. Supplanting this ecosystem is going to take time.

CNPC Pledges to Reduce Emissions

The Chinese state-owned O&G company, China National Petroleum (CNPC), has joined a pledge to reduce methane emissions to zero by 2030, along with reaching net zero emissions by 2050.

CNPC aims to see the peak of its emissions levels by 2025. Inevitably, this will require the use of carbon credits and carbon capture. The same goes for all O&G firms. There aren’t any other viable methods of reducing emissions from fossil fuel production.

A total of 52 international O&G companies have signed the Oil and Gas Decarbonization Charter. Those firms represent 44% of the world's total oil production.

Other signatories include BP, Eni, ExxonMobil, Saudi Aramco, and ADNOC.

The Carbon Markets Await Judgement Day

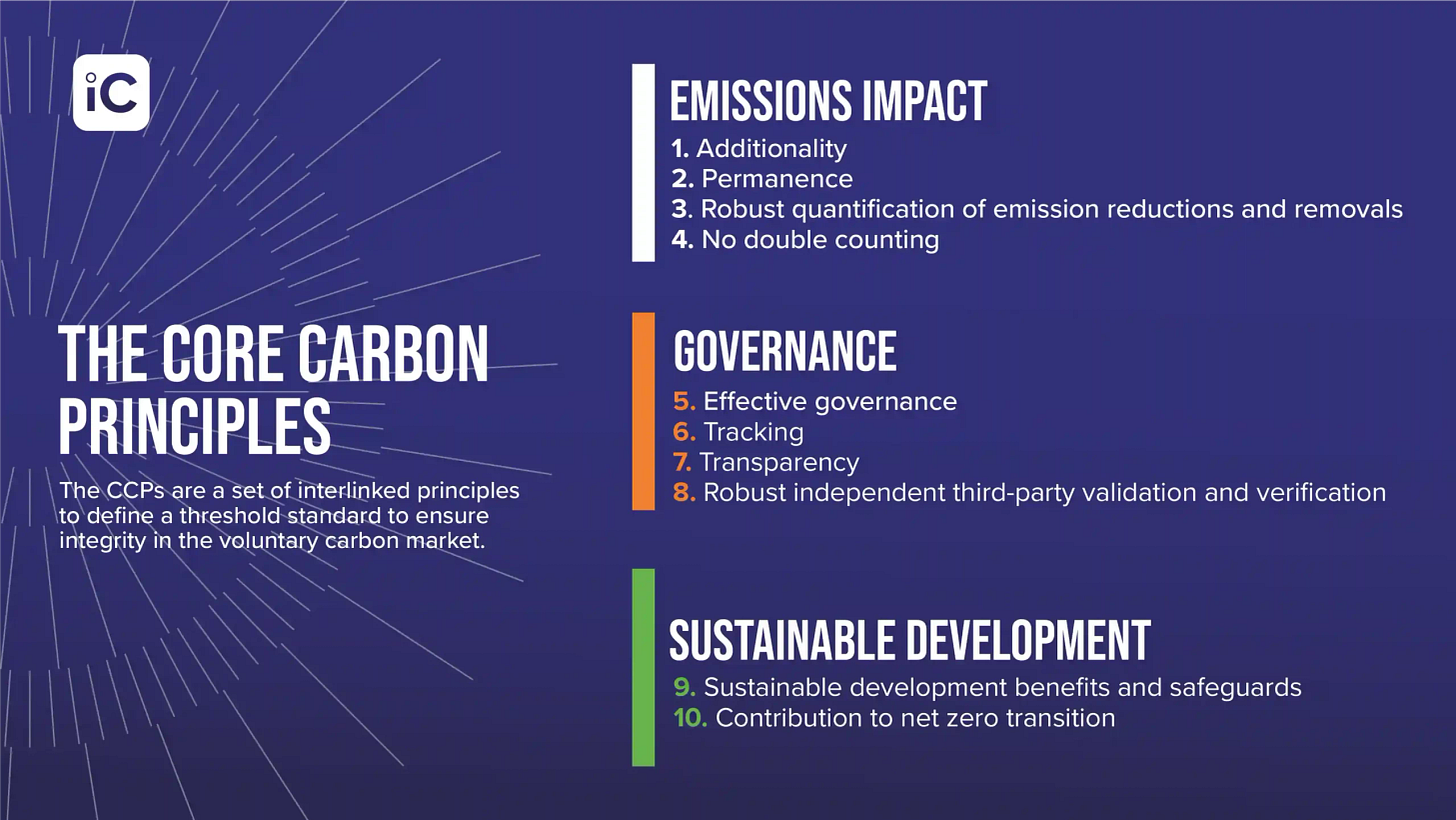

The Integrity Council for Voluntary Carbon Markets (ICVCM) is expected to release its first batch of carbon methodologies that will qualify for its Core Carbon Principles (CCP) label.

As of January, the ICVCM is in the process of evaluating more than 100 carbon methodologies.

Liquidity in the VCMs has dropped as the markets anxiously await an announcement from the independent standards body.

Results are expected to be released at the end of March.

According to analyst estimates, approximately 6% of historically issued carbon credits are expected to meet the CCP’s expectations. So this could result in a massive supply crunch if the market strongly favors the credits that do get approved.

Carbon Credit Insurance

CFC, a specialty insurance provider, is launching a carbon delivery insurance policy.

This is a service that would cover 100% of a purchaser’s carbon credit investment in the case of non-delivery. A crucial addition to a market that faces credibility issues via controversy at the leading carbon registry, Verra.

The company surveyed 549 firms involved in the VCMs to query potential demand… and these were the results:

75% of existing buyers are 'very concerned' about delivery shortfalls.

65% have experienced losses from non-delivery.

80% said they are very like to consider purchasing under-delivery insurance.

50% of non-buyers said they would be more inclined to purchase voluntary carbon credits if they could insure them against non-delivery risk.

Given these results, it’s safe to say that insurance providers will play an increasingly large role in the carbon markets.

According to Oxbow Partners and Kita, specialty insurance firms, the carbon credit insurance market could be worth $1B on its own by 2030. $10-30B by 2050.

Carbon insurance brings a degree of security that these markets previously lacked.

Without delivery risk or credibility concerns, more companies will be willing to engage in the carbon markets than before. This is in addition to other reforms already ongoing across the marketplace.