The Financial Incentives Behind the Energy Transition

The world won't decarbonize until it's cheaper to go green than not.

Any decarbonization efforts depend on economic viability.

If it’s not cheaper or required for a company to engage in reducing their emissions… then they’re not going to.

Corporations aren’t run like charities, if there isn’t a clear benefit to any cost, it’ll get cut eventually.

As we saw before 2021, a world of low interest rates and prosperity allows for significant levels of waste. Once the party stops, so does the reckless spending.

So how do we financially incentivize the energy transition?

Emissions Trading Systems

Enter our first way of enticing the market to change its behavior: emissions trading systems (ETS).

Also known as cap-and-trade schemes or compliance markets, an ETS regulates heavy-emitting industries and outlines an emissions cap that decreases yearly.

Carbon allowances are given out to market participants, which they can use to cover their climate obligations…

If a company exceeds its allowed emissions level, it’ll have to pay another company for extra allowances to offset the gap. This helps determine the price of carbon in a region.

In theory, the price of carbon allowances will continue to increase over time as the supply of allowances is constricted.

The price increase seems gradual enough to avoid driving out industrial players altogether.

Incentives are clear, reduce your emissions and it can become an additional revenue stream as you sell your allowances to other companies. Assuming you can find relatively low-cost ways of abating your emissions.

An ETS represents a market-driven way of combating the climate crisis. They can also be incredibly effective…

The EU has the largest compliance carbon market in the world, and the region has reduced its emissions by 43% since the EU ETS was created in 2005.

As an investor, you can get exposure to compliance systems in the public stock markets. I talk about all of the possible investment options in this video.

Carbon Taxes

Another major driver for the energy transition is the usage of carbon taxes.

Approximately 25% of the world’s greenhouse gas (GHG) emissions are covered by a pricing mechanism or carbon tax.

Pretty self-explanatory, a carbon tax is often levied on products or services that create significant GHG emissions.

Carbon taxes and emissions trading systems are the primary, long-term drivers behind the increasing demand for carbon capture solutions. This is a topic I covered in a recent video on investment options in the space.

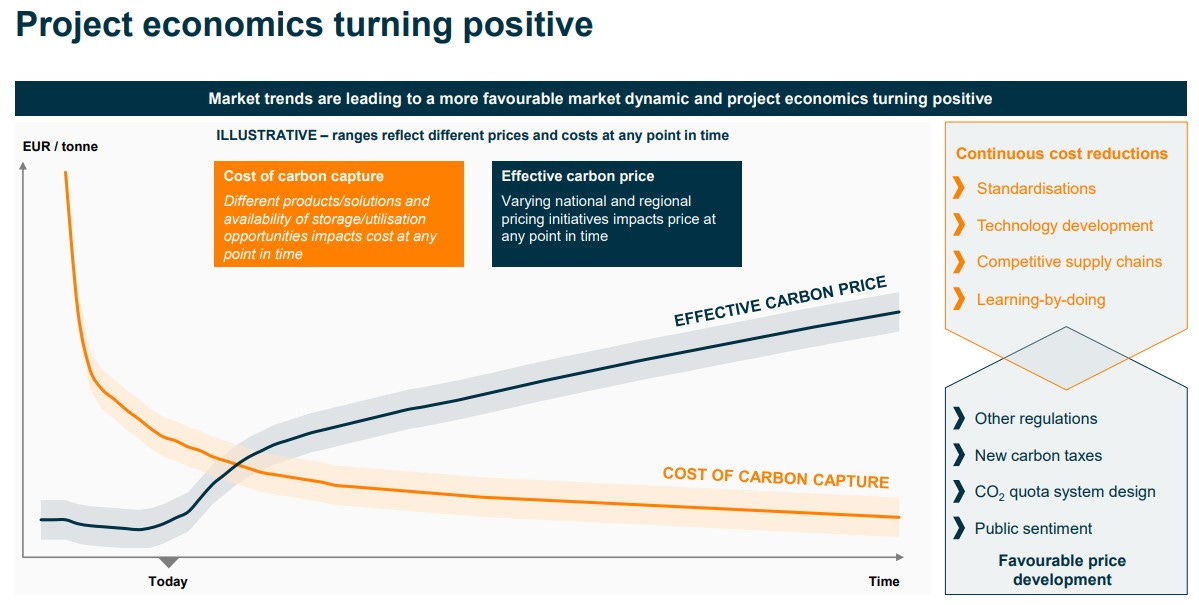

The higher the “price of carbon,” the more likely an emitter will make the investment required to abate their emissions and dodge that bill. With the cost of carbon capture being around $100-$150 per ton, the economics are starting to make sense in certain jurisdictions.

Carbon Tariffs

To avoid encouraging businesses to outsource their production to other parts of the world… countries will begin to implement adjustment carbon taxes on imported goods. Carbon tariffs.

The EU is already discussing the creation of a Carbon Border Adjustment Mechanism (CBAM), set to take effect in 2026.

To offset emissions created during the production of any taxed good/service, the importer will need to buy CBAM certificates.

Goods that’ll be affected under this tax include: cement, iron, steel, aluminum, fertilizers, electricity, and hydrogen.

This tax will vary depending on the weekly average auction price of allowances within the EU ETS.

Green Bonds

Next, we have green bonds.

Green bonds are debt instruments specifically designed to provide funding for environmentally-friendly projects.

In contrast to other bonds, the recipient may qualify for tax credits or exemptions. This lowers the company’s cost of capital.

Again, this can make it cheaper to finance cleaner investments.

The green bond market is the fastest growing of any bond market, currently valued at around $1T.

Green Subsidies

Lastly, we have government-led financial support like subsidies, grants, tax credits… the list goes on.

In many ways, the explosive nature of the decarbonization trend will be determined by the willingness of governments to support it.

Technologies like carbon capture or the hydrogen fuel cycle are often unprofitable without assistance.

We are witnessing one form or another of carbon pricing emerge across the globe:

We’ve already mentioned how the EU is engaged in multiple avenues including its compliance carbon market, subsidies, carbon tariffs…

Canada has introduced a carbon tax and is discussing building their own ETS.

The United States has the Inflation Reduction Act. Several groupings of states have their own cap-and-trade schemes.

In 2020, China initiated an ETS to reduce emissions from coal and gas-fired power plants.

India created a compliance carbon market as well, called the Carbon Credit and Trading Scheme (CCTS).

Brazil is launching its cap-and-trade scheme by 2030.

This is just a short list of everything coming to fruition in the last few years. Given the success of the ETS in the European Union, various countries around the world are in the process of developing their own.

Regardless, a variety of financial incentives are emerging to not only benefit the carbon markets, but any possible green investment opportunity you can think of.

With that said, that doesn’t necessarily mean every company in this space will provide great returns for investors.

Determining which stocks will, is what I’ve dedicated my content to.

Follow along on X and YouTube to learn more.