Crown LNG: An Alternative For Tellurian Investors?

A review of Crown LNG, a newly listed LNG stock.

Tellurian TELL 0.00%↑ is the developer of the Driftwood LNG liquefaction project in Louisiana.

Given the stock’s decline, many Tellurian investors were disappointed to see Woodside Energy buying out the company for $1.2 billion (including debt).

With a buyout at just $1 per share, nearly all investors in the stock are losing money on this deal. The transaction is expected to close in October.

Assuming the deal goes through, that leaves everyone wondering where they might want to invest next.

Let’s see if the newly listed Crown LNG CGBS 0.00%↑ has promising fundamentals…

Crown LNG

Crown LNG (CGBS) merged into a SPAC with Catcha Investment Corp to list on the Nasdaq in July. It didn’t take long for the stock to crash, now sitting at a stock price of just $0.28. I’ll touch on why I think the stock price collapsed later on.

The Business Plan

Crown plans to build large liquefaction and regasification facilities for LNG.

Liquefaction is the process that supercools LNG into a liquid, so it can be transported overseas.

Regasification is the process that turns that liquid back into a gas so it can be transported and delivered to consumers.

Plenty of companies do this, as we’ll discuss… the twist with Crown is that they plan to build them offshore, in harsher weather conditions than traditional LNG facilities.

As they list out above, there are a variety of benefits to building offshore facilities instead of going on land.

While building LNG infrastructure is complicated and capital-intensive, no matter where it is… the ocean makes things a bit easier.

There are existing operators that provide offshore facilities, but they use floating-based infrastructure, which works well in more benign weather conditions.

On the other hand, Crown is specifically focused on gravity-based facilities, which can survive harsher weather.

The only other company that has built a facility similar to what Crown is proposing is Adriatic LNG in Italy, which is owned by Exxon and Qatar Energy. But that proves this has been done before and that the technology works in this application.

Many of these gravity-based structures (GBS) have been built by Aker Solutions.

Crown has partnered with Aker Solutions, who helped build the Adriatic LNG facility. Crown is also working with Siemens Energy, and Wartsila Gas Solutions. So Crown has brought in some of the leading contractors and suppliers to build out their projects.

Projects

Crown has highlighted that it has a variety of opportunities to build facilities worldwide. The dark blue circles represent the most troublesome areas with tropical storms that can present issues for traditional infrastructure.

Crown’s SPAC transaction raised the company $50 million, which brought $40 million to the balance sheet after $10 million was spent on finalizing the SPAC deal.

That $40 million is expected to bring their first two projects to their final investment decisions (FID).

Their first project is going to be a more traditional floating storage regasification unit in Grangemouth, Scotland. Crown is targeting an FID by the third quarter of 2024. First gas tolling is expected to occur in the first quarter of 2027.

The second project is in Kakinada, India. Crown is targeting an FID by the third quarter of 2025, with first gas-tolling revenues to come in by the first quarter of 2028.

Afterward, Crown will be exploring project opportunities in Vietnam and Canada.

Project Economics

The project in India needs another $34 million in CAPEX, and the project in Scotland needs another $6 million. So, that’s how we get to FIDs for both of these projects with the capital they already raised.

Reviewing the economics of these projects, we’ll start with Scotland. They have an agreement in place with a nearby power plant being developed by GBTron, which should be online by 2030.

GBTron takes up 40% of the potential volume.

The UK National Grid and other end customers will have the remaining 60% of potential capacity.

In this project, Crown will charge a tolling fee every time a customer wants to use their regasification facilities.

This could total up to $276 million in annual revenues by 2030, and potentially even earlier, as Crown can bring on additional capacity with spot contracts until GBTron is ready. $166 million of the revenues generated will ramp up by 2027.

As for the project near India, Crown is in advanced discussions with Indian regasification customers to sign long-term agreements for terminal use. In total, Crown expects the project to generate $286 million in annual tolling revenues

60% of terminal capacity will be reserved for strategic customers.

25% will be for private enterprises.

15% will be used for shorter-term contracts, as negotiated by regulators.

Once projects reach that final investment decision, Crown estimates they’ll tend to take around 3 years to build. The project in India will take around 6 months longer than the project in Scotland, according to the company’s estimates.

In total, the company plans to raise around $1.5 billion to cover capex in both regions. The funding mixture will consist of 80% debt and 20% equity financing. The company plans on selling 25% of the ownership in their projects outside of the debt capital.

Theoretically, Crown won’t need to rely on the stock market for financing.

Crown emphasized using long-term Terminal Use Agreements (TUAs) to ensure that the projects are bankable so that banks would be willing to debt finance Crown’s operations.

With an expected EBITDA of $395 million in 2028, taking 75% of that figure (Crown’s pro-forma ownership) would peg Crown with approximately $296 million in EBITDA.

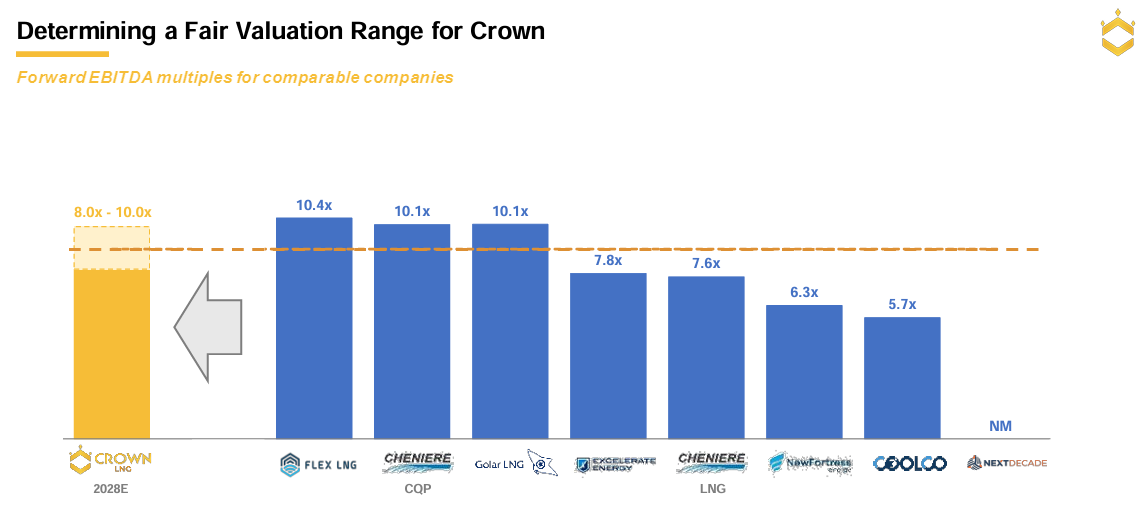

Comparing the forward EBITDA multiples of their peers, around 8 to 10x…

Then the company would be trading at around $3 billion in market cap. That’s a far cry from today’s market cap of $19 million. Theoretically a 150x return.

My Concerns

With that said, here’s where I get into my problems with this company.

Capex-intensive industry is complicated and prone to delays or significant cost overruns. Of course, it’s not guaranteed to happen, but it wouldn’t be a surprise if it did.

We just saw this happen with the Golden Pass LNG project in the US, backed by Qatar and ExxonMobil. That project has seen over $2 billion in additional costs, and the contractor working on it, Zachry Industrial, was forced to declare bankruptcy.

According to Reuters, labor costs on these LNG job sites have increased as much as 20%.

So, what happens if Crown runs out of money? It’s something to consider.

Not only that, but investors would need to wait, at the very least, 3 to 4 years for any revenues to be generated. That’s assuming there are no delays. A 150x return would be worth that wait, but there are a lot of assumptions being made.

In my last post about Crown, I outlined how it appears that the SPAC sponsors— and possibly the management team as well, sold out of the stock shortly after it listed. That could explain why the stock price has crashed in just a few months.

Catcha Holdings, the SPAC sponsor with 10% ownership in Crown, sold or transferred all of their stock immediately. We can’t confirm for certain if management sold or not…

But if that’s the case, it doesn’t exactly scream, “We believe in this company.”

I see no reason to take on significant risk by owning Crown when another stock I own, Abaxx Technologies, is a less direct but still significant beneficiary of increased demand for LNG.

They operate an already launched commodity exchange, which is in the process of ramping up trading volumes on their LNG and carbon commodity futures contracts.

You can find the full investment thesis here:

Disclaimer

The owner of Green Investing is not a licensed investment professional. Nothing produced under the Green Investing brand should be construed as investment advice. My content is made for entertainment and educational purposes. Do your own research.

I agree with your reasoning on this. ABAXX is a better way to play it. I have invested in capital intensive companies with mixed results. I am up about 40% on ABAXX, but will dollar cost average going forward on a scheduled basis since the story remains intact for this company to do well over the next few years, if not longer.