Base Carbon: 380% Upside Carbon Credit Stock

Video: A review of Base's recent call with WTR, and CORSIA market dynamics.

Transcript

Base Carbon is a carbon project financing stock, currently sitting at around a $40 million market cap. Full disclosure, I own shares in the company.

The company’s president, Wes Fulford, just had an interview with Water Tower Research to review upcoming catalysts for the stock. So in this video, we’ll go over what he said in that interview, and why Base Carbon is so undervalued right now.

Now, if you’re just learning about Base Carbon for the first time, or would like to refresh yourself on the company, then in the description I’ll link to a write-up I made about the stock back in March. So take a look at that.

But we’ll start off by talking about the market dynamics of the voluntary carbon markets. This was a key theme of Wes’ call with Water Tower. Specifically, the impacts of CORSIA.

CORSIA is the carbon offsetting scheme for the international aviation industry. It’s the first global system that’s industry-specific for offsetting carbon emissions with carbon credits.

The International Civil Aviation Organization (or ICAO) enforces the rules behind CORSIA, which is separated into three phases.

A pilot phase was conducted from 2021 to 2023, and since January 1st, 2024, we’ve entered the first phase, which runs from 2024 to 2026. These two phases were voluntary, meaning that participants needed to volunteer to offset their emissions.

The last phase, aka the second phase, runs from 2027 to 2035, and that will be mandatory for all participants except for small islands and less developed countries.

As things stand now, CORSIA has 126 participating countries, 54 of which are small islands or developing nations. So, by 2027, 72 countries would be required to have airlines operating in their countries offset their emissions.

Barring some major technological innovations, which will take time to implement regardless, airlines have two options for avoiding carbon emissions.

They can reduce emissions at the source by using sustainable aviation fuels instead of jet fuel, which are typically created from some type of plant or natural oil-based feedstocks, instead of petroleum.

The other option is using carbon credits created by projects that reduce or remove carbon dioxide emissions from the atmosphere. Some common examples of project types from the voluntary carbon markets would be avoided deforestation or cookstoves that reduce fuel use in rural or less developed areas.

When comparing the cost of the two offsetting options, carbon credits are the clearly superior choice.

Estimates for how much sustainable aviation fuel costs to use can vary depending on how its created, but Wes Fulford said he was seeing around $400 to $700 per ton of CO2 being the average cost.

That’s essentially as expensive as direct air capture, which is considered early-stage technology, and costly to scale. So the projects creating SAF are similarly expensive. Those costs can go down over time as more companies use that technology, but that will take time.

Now, compare that to the cost of CORSIA-eligible carbon credits trading on the Intercontinental Exchange, aka ICE… the futures trade for around $30 right now. So, as things currently stand, using carbon credits is significantly cheaper. Most airlines should opt for using carbon credits to offset their emissions given the economics. You can already see that the price of CORSIA credits have risen from around $10 in March to $30 here in July. So things are starting to take off.

By the way, as I was making this video, ICE just terminated trading on its December 2024 CORSIA Phase One contract because of a lack of deliverable supply. The price jumped too high, too fast, so ICE pulled the plug. So, that tells you all you need to know about the current state of the market right there.

Anyway, what will be interesting to watch is how the CORSIA market evolves, because there aren’t many projects in the carbon markets that can generate eligible credits right now. This is why while the futures prices are rising, the trading volume isn’t very high on this contract.

For a carbon credit to be eligible for CORSIA, they need to meet three criteria:

The carbon credit needs to be generated in 2021 or later. That already eliminates 70% of the existing supply in the voluntary carbon markets.

The carbon credit needs to come from a CORSIA-approved carbon registry.

The carbon credit needs to be correspondingly adjusted under the project’s host country’s nationally determined contributions, or NDCs.

NDCs refer to the commitments each country in the Paris Agreement has to reduce greenhouse gas emissions. When a project is correspondingly adjusted under Article 6.2 of the PA, that removes the possibility of double-counting carbon credits under a country’s NDC.

The host country of the carbon project from which a CORSIA-eligible credit is coming needs to sign off and say that it won’t count that carbon credit toward offsetting its emissions so the credit can be accounted for as being used outside of that country, in this case, for the airlines participating in CORSIA.

Right now, only around 25 to 30 projects in the voluntary carbon markets have that corresponding adjustment (or CA) label for their credits. So the supply of CORSIA credits is very tight. Some analysts are even worried that CORSIA could fail altogether because supply is so limited.

But having a scheme for an industry like the airlines, with limited carbon credit supplies, is great for the projects that are eligible. That’s what will benefit Base Carbon

The company has three carbon projects in Vietnam, Rwanda, and India. The two cookstove projects in Vietnam and Rwanda, which are both already generating carbon credits, have been mentioned as likely projects for CORSIA eligibility.

Rwanda already has corresponding adjustment approval, aka the CA label, from the Rwandan government.

Now, when it comes to the Vietnam project with the project developer SIPCO, Base has already provided estimates that it would receive 6 million carbon credits from Vietnam this year. Those credits are being sold into an offtake agreement with Citigroup for $5.75 per credit, which totals up to $29 million in revenues. That’s just from one project. On average, the project will generate around 3.5 million credits per year.

Base already received $12.5 million in revenues from selling 2.2 million credits in their first issuance of credits from Vietnam in April, and they expect to receive another issuance of credits in this quarter. The third issuance, which would bring the total of credits up to 6 million in the year, will likely be received early in Q1. So, that will technically be next year, but it’s pretty close.

After these 6 million credits are received, that will mark the limit of the offtake agreement, at which point Base has the option to purchase an additional 25 million credits from SIPCO for $5 per credit. Assuming this project manages to snag a corresponding adjustment label, then the credits would likely be sold for at least $10. If they get sold for usage in CORSIA, then as we saw with the ICE futures, they can go for $30 or more. Significantly higher prices than the market average for cookstove credits of around $4 to $6.

Looking at a DCF model for the Vietnam project, 2024 is the year concluding the 7.4 million credits going to the Citi offtake, but after that Base would be buying 75% of the credits for $5 from SIPCO and selling them for around $10 because that was a cap set during negotiations with the project developer. So that does limit the upside, but 25% of the credits generated would be sold for the market price or into another offtake, so if we plug in $30 then Base would be generating between $30 to $40 million in revenues per year until 2031. This doesn’t even include the potential upside from a 50% expansion of the project, which Base confirmed they would do if they got a CA label for Vietnam.

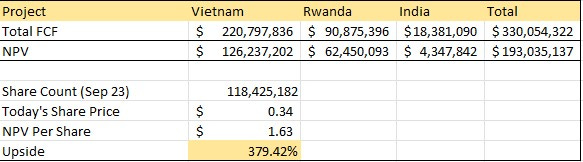

In total, the NPV of the project would be $126 million if Base got similar pricing to what we’re seeing with CORSIA right now. We don’t know what price they’ll ultimately get for those credits, but this is illustrative of what that could look like.

In addition to receiving 6 million credits from Vietnam, Base also projected they would receive 2 million credits from their cookstove project in Rwanda this year. 700,000 of those credits have already been issued to Base.

Rwanda is also already approved for the CA label, so they should be able to be used under the CORSIA scheme soon. So running under the assumption that Rwanda could get $30 pricing for its credits as well, then this project will generate substantial cash flows as well.

It’s worth noting 12% of the credits need to be provided to the Rwandan government or retired, but the rest go to Base. The share of the profit that Base gets would be around 90% in 2024, and then probably around 60% for the remaining years. As the price of the credits rises, so does the share of the profit that Base is receiving in comparison to the project’s developer DelAgua. Base doesn’t say exactly what those numbers will be, but this is an approximation.

So we can see that the NPV of the Rwanda project would be $62 million at a $30 price per credit.

Adding up the value of the Vietnam and Rwanda cookstove projects, as well as Base’s India reforestation project, the total NPV of the company would be $193 million. That is an NPV of $1.63 per share. Compared to the current share price of $0.34, that is an upside of 380%. This is just the upside to get to 1x NPV. This isn’t even valuing the company on any market multiples, which could value the company significantly higher than that. This is just the value of the stock’s existing carbon projects.

Now, this level of upside is about as obvious as you can get, cash flows are already rolling in regularly, the value of carbon credit projects are relatively dependable and easy to estimate in a DCF. So, why is this stock so undervalued?

It really all comes down to the industry this company operates in…

As I’ve touched on in other videos, disdain from both the left and right, various controversies in the voluntary carbon markets and the decline of ESG investing have led to a hatred for carbon credits as a form of offsetting emissions. No one likes this industry, so Base Carbon isn’t being valued fairly.

Barring some black swan, like the carbon markets collapsing entirely, which I would think is unlikely, this presents an interesting opportunity as Base continues to acquire new projects, generate substantial cash flows, and buy back its own shares…

ICAO, the organization overseeing the CORSIA scheme, has a meeting scheduled for November to outline offsetting requirements as CORSIA’s first phase ramps up. Corporates looking to secure supply would likely start to position themselves around or before this time. So, we’ll see if Base signs offtake agreements or sees other activity in the coming months.

I don’t know if CORSIA will be the catalyst to make Base Carbon re-rate higher, or what other catalyst might do it, but Base has made incredible progress.

To provide some perspective, Base was created and funded in 2021. So, in the span of around 3 years, Base went from a concept to creating at least $30 million in cash flows annually from several carbon projects. None of the other public carbon credit companies come even close to matching that, and most microcaps never get even close to what Base has done.

So, I am quite pleased to be a shareholder.

Excellent writeup, thanks for sharing your work on Base. What’s so eye opening to me is the cost to offset a tonne of emissions via SAF relative to the cost to offset a tonne of emissions with a CA CORSIA credit. If the ultimate goal is to offset emissions then this analysis reveals that SAF costs around $300 to offset a tonne of emissions where a CA CORSIA credit is “only” $20-$40 at the moment. One has to imagine that airlines will do that analysis and choose to offset via CORSIA credits up until a price around $100 or so. Crazy to think about.